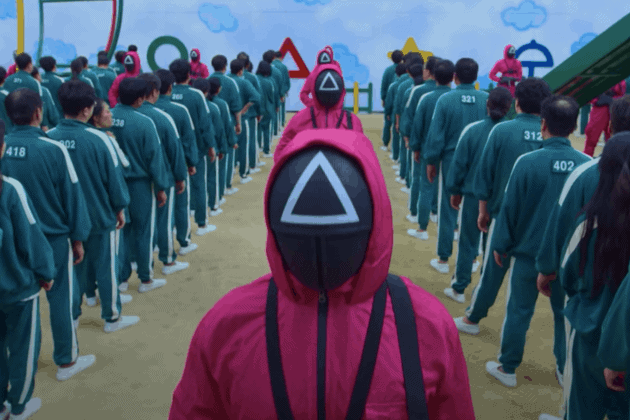

Korean entertainment has grown immensely popular with consumers and stock investors alike, with boy band BTS, addicting “Baby Shark” tunes, and now survival drama Squid Game, causing some speculation about where the next successes may come from.

Squid Game, the country’s latest phenomenon that has topped Netflix Inc. rankings all around the world, has also prompted some significant stock price increases. This month, the stock of Bucket Studio Co., which has a share in the agency that represents the show’s star actor, has more than quadrupled. ShowBox Corp. has risen 55 percent since its predecessor invested in Siren Pictures, the show’s privately held production company.

Netflix has increased its projected expenditure on Korean movies and TV series to $500 million this year, indicating that global streaming firms are increasing their investment in Korean content. Hit content, like successful stocks, may be difficult to predict.

“Any firm may generate a hit,” said Lee Kihoon, a Hana Financial Investment Co. analyst who rates Studio Dragon Corp., CJ ENM Co., and Jcontentree Corp. as buys. “We can’t predict who will make the next ‘Squid Game,’ because it might be anyone,” he added.

Nonetheless, given its large $2.2 billion market valuation in an industry with numerous tiny competitors, Lee believes Studio Dragon is a “must-buy” for investors looking to make bets in the Korean entertainment business. Studio Dragon is a subsidiary of Korean cinema powerhouse CJ ENM and the producer of “Hometown Cha-Cha-Cha,” another presently popular Netflix programme.